Why Tariffs? Genius or Imbecile?

Trump insists on tariffs. He calls them leverage, a tool only he can wield, but what are they really?

According to Business Insider, “Everything from laptops to cars is likely to keep rising” and consumers may absorb 67% of tariff costs by October of this year.

What Are Tariffs and Who Pays?

Tariffs are taxes on imports. The cost hits U.S. consumers and businesses, not foreign exporters.As Yale’s Budget Lab estimates, the 2025 tariff regime is forecast to push consumer prices up about 1.8% in the short run and up to 2% overall. Leather goods could rise 39%, apparel 37%, textiles 21% and even food by 3-4%.

Estimates suggest the average household will shell out $2,700–$4,700 more per year.

The costs are regressive: the lowest-income households lose ~3.5% of their income, high-income ~1%.

Make no mistake: That is not empowerment, that’s a tax on Americans.

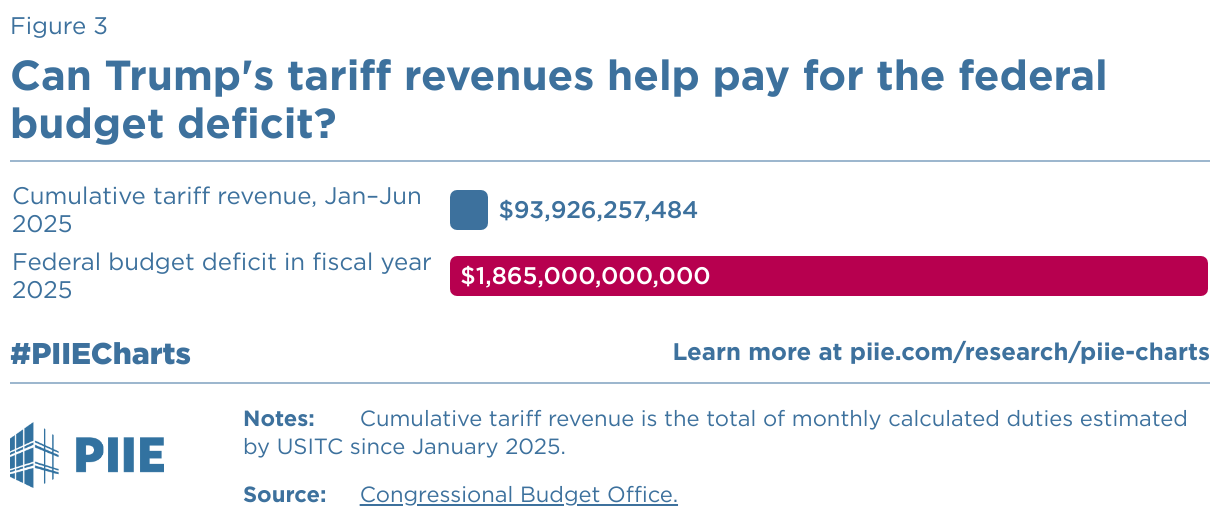

Tariffs by the Numbers

Headline rate increases across the board:

10% baseline on all imports from April 2025

Up to 41% on goods from dozens of countries (July)

50% on steel, aluminum, copper

25% on autos and auto parts

30% on Chinese goods (includes "fentanyl tariff")

By mid-2025, tariff revenue reached $94–108 billion (still just 5% of total federal revenue).

Meanwhile, Goldman Sachs projects that by October, 67% of tariff cost will land on consumers (up from 22% earlier).

Economic Fallout & Legal Pushback

Yale’s data shows tariffs squeeze real GDP, lower employment, and delay jobs while adding 505,000 fewer payrolls, 0.5pp to 0.7pp increase in unemployment, and erasing ~$125B/year in output.

Consumers are already seeing it. Inflated lunch prices (+6% on a PBJ sandwich), surging beef (+11%), $39B expected spent back-to-school, and tariffs tilting grocery bills by $2,400/year.

Retailers are feeling the squeeze. Furniture giants like RH and Wayfair face cost shocks, supply shifts, and production reshoring.

Legal brake lights are flashing too. A key court ruled Trump’s "emergency" tariff moves exceeded executive authority under IEEPA, blocking the "Liberation Day" tariffs.

Why Tariffs, Then?

They're simple and loud (i.e. easy to brand as toughness).

They give executive control without Congress.

They confuse price hikes for national defense.

But they’re not sustainable. Other tools (industrial policy, investment, multilateral deals) are messier and require buy-in. Tariffs are a spectacle, not an economic strategy.

Genius or Imbecile?

Short-term: Maybe a scoreboard tweak.

Long-term: A self-inflicted tariff tax that punishes Americans and fractures diplomacy.

Tariffs aren’t genius. They’re narrative. They let a president stand on stage like a protector while everyone pays the freight.

TOW

President as protector is theatrical. Real protection comes from policy, not taxes.

ETHER

The tariff isn’t patriotism. It’s a ticket buyers end up paying for the show.

Links you might have missed: